Robocash Review

Quick Overview

Platform Age

Launch Year

Loans Funded

Total Volume

Number of Loans

Processed Loans

Default Rate

Historical Average

-

🎯

Investment Focus

Short-term consumer loans across multiple countries with terms ranging from a few days to 12 months.

-

📊

Expected Returns

10.5% to 11.8% average annual returns with fully automated reinvestment of principal and interest.

-

🛡️

Safety Features

30-day buyback guarantee, backed by UnaFinancial Group with all loan originators within the same group.

-

💰

Liquidity Options

Secondary market available for selling investments before maturity, increasing portfolio flexibility.

Standout Features

Exclusively automated investment process

No fees for investors for any transactions

All loans from within UnaFinancial Group

Automated payout scheduling options

Investment Calculator

Total Investment Value

Recommended Strategy

Your long-term approach with reinvestment maximizes compound growth. Consider increasing your monthly contributions for even better results.

Our Experience with Robocash

Since August 2024, we’ve been testing Robocash with a dedicated portfolio of €3,000 to evaluate its performance, usability, and reliability. Here’s what we’ve found after six months of hands-on experience:

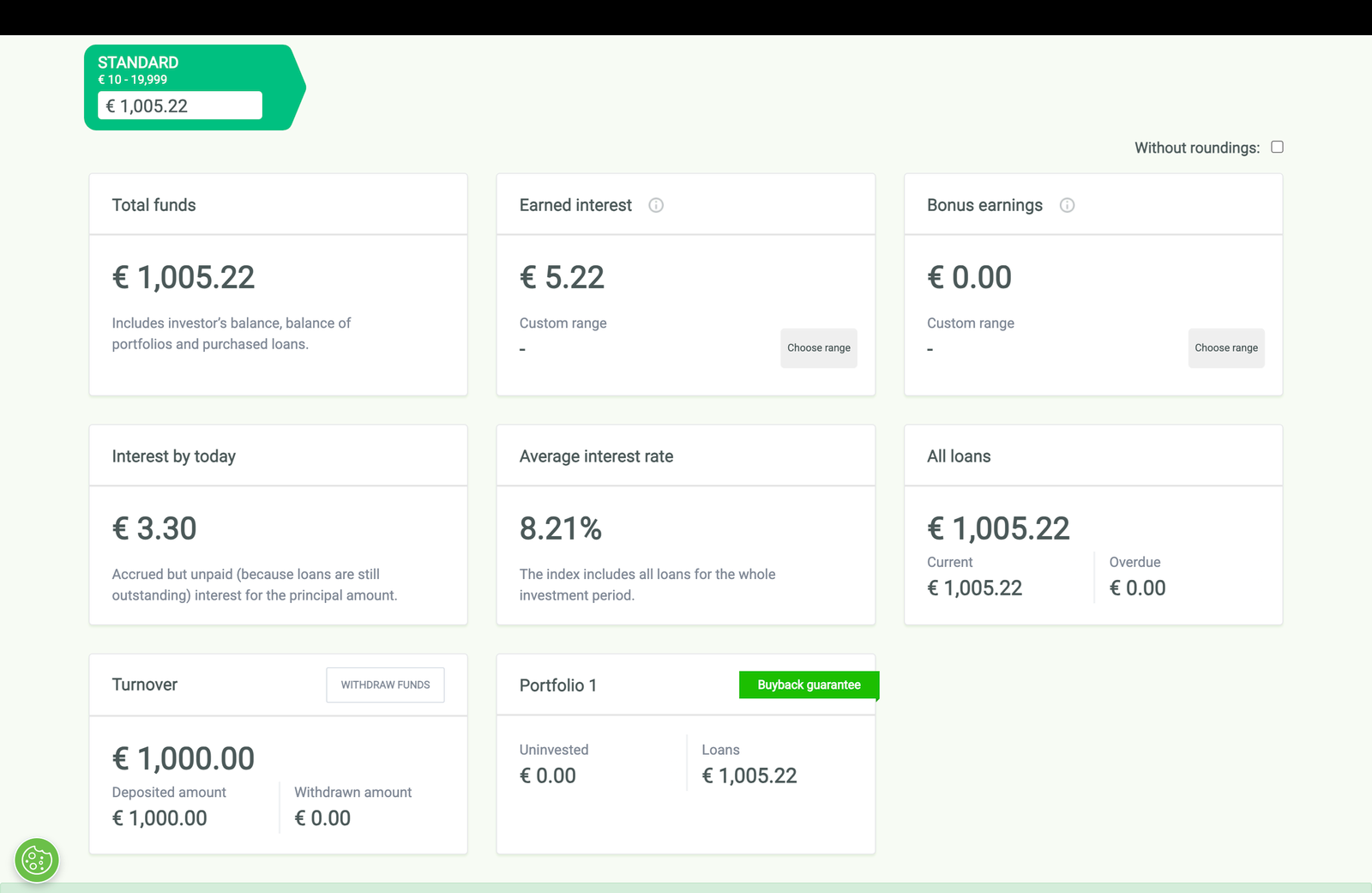

Our Test Portfolio Results

What Impressed Us

- ⚙️ True “set and forget” automated investing

- 💰 Consistent returns with daily interest payments

- 🏆 No transaction fees at any stage

- 🛡️ Reliable buyback guarantee that works as promised

- 📊 Clean, intuitive dashboard with clear performance metrics

Room for Improvement

- ⚠️ Occasional cash drag due to loan availability

- 🔒 No manual loan selection options

- 📱 Mobile experience could be more robust

- 📞 Support response times sometimes slow

- 🏛️ Limited regulatory oversight

Real-World Performance

With our €3,000 test portfolio fully automated through Robocash’s auto-invest feature, we’ve experienced:

- Daily Interest Accrual: Interest credited daily, providing a smooth return curve with no unexpected fluctuations.

- Buyback Guarantee in Action: Approximately 1.8% of our loans went into the buyback process, which executed flawlessly with principal and interest returned within 24 hours of the 30-day mark.

- Secondary Market Use: We tested selling 20% of our portfolio on the secondary market after 3 months, which completed within 48 hours with no transaction fees.

- Cash Flow: Tested both reinvestment and regular withdrawal options, both functioning as expected with scheduled payouts delivered on time.

Key Observations

- Platform Stability: No downtime or technical issues encountered during our testing period.

- Investment Process: Truly passive – we didn’t need to make any adjustments after initial setup.

- Risk Management: UnaFinancial backing provides confidence in the buyback guarantee system.

- Customer Service: Average response time of 18 hours, with varying quality of support depending on query complexity.

Final Opinion

Robocash delivers exactly what it promises: a hands-off P2P investment experience with solid returns. The platform’s greatest strength is its simplicity and automation, making it ideal for investors who prefer a passive approach. While the lack of manual selection options may frustrate more active investors, this is by design rather than limitation. The platform’s integration within the UnaFinancial Group provides an unusual level of transparency about loan originators. For investors seeking reliable returns with minimal time investment, Robocash offers one of the most streamlined experiences in the P2P market.

Video Review

🎯 Video Chapters

Platform Safety Analysis

⚠️ Key Risk Factors

- Platform operates without specific financial services license

- Regulatory framework in Croatia is less structured than in other EU markets

- Buyback guarantee relies entirely on UnaFinancial Group’s financial health

- Concentration risk as all loan originators belong to the same corporate group

Regulatory Status

-

!

Not regulated under specific financial services license

-

✓

Operates in compliance with Croatian laws

-

✓

Parent company UnaFinancial is financially audited

-

✓

Transparent corporate structure and reporting

Rückkauf-Garantie

-

✓

30-day buyback guarantee on all loans

-

✓

Principal and accrued interest repaid

-

✓

Parent company reported €24M profit (2020)

-

!

Dependent on UnaFinancial Group’s financial health

Platform Stability

-

✓

Operating since 2017 with clean track record

-

✓

€595M+ total loan volume processed

-

✓

Less than 2% default rate historically

-

✓

Parent company operates in multiple countries

Investor Protection Features

Buyback Timeline

Auto-activation after 30 days with interest paid for the delay period

Geographic Diversification

Loans across Spain, Kazakhstan, Singapore, Philippines, and Sri Lanka

Lending Transparency

All loan originators within UnaFinancial Group with published financials

Sekundärmarkt

Ability to exit investments before maturity without fees

Company Background

Robocash was founded in 2017 in Latvia and relocated to Croatia in 2019. The platform is part of UnaFinancial (formerly Robocash Group), an international financial holding operating since 2015 across Europe and Asia:

-

✓

Founded by Sergey Sedov, who continues as CEO

-

✓

Group employs approximately 1,800 people worldwide

-

✓

UnaFinancial reported €325.3M turnover in 2021 (150% increase from 2020)

-

✓

Offices in Croatia, Spain, Kazakhstan, Philippines, Singapore, and Sri Lanka

Platform Interface & Features

Main Dashboard

Clean, intuitive interface showing portfolio performance and account balance

Auto-Invest Settings

Configuration panel for setting up automated investment parameters

Performance Statistics

Detailed analytics and reporting on investment performance

⚙️ Auto-Invest System

-

✓

Fully automated investment process

-

✓

Customizable investment parameters

-

✓

Automatic reinvestment of principal and interest

-

✓

Scheduled payout options

🔄 Sekundärmarkt

-

✓

Fee-free buying and selling

-

✓

Fast transaction processing (typically 24-48 hours)

-

✓

Higher usage among experienced investors (70% of large portfolios)

📊 Account Dashboard

-

✓

Real-time portfolio overview

-

✓

Detailed transaction history

-

✓

Performance metrics and analytics

-

✓

Account statements and reporting

Auto-Invest Configuration Options

Reinvestment Mode

Automatically reinvest principal and interest for maximum compound growth

Income Mode

Reinvest principal, but withdraw interest for regular income

Scheduled Payouts

Configure automatic withdrawals on specific dates for planned expenses

Available Loan Types

🇪🇸 Spanish Consumer Loans

Short-term consumer loans from Spanish market, with manageable loan amounts and quick repayment cycles.

🇰🇿 Kazakhstan Loans

Higher-yield loans from the Kazakhstan market, offering the maximum platform return rate with slightly longer terms.

🇸🇬 Singapore Loans

Medium-term consumer loans from the Singapore market with stable returns and moderate risk profile.

🇵🇭 Philippines Loans

Longer-term consumer loans from the Philippines market, offering slightly higher returns for extended investment periods.

User Experience & Reviews

👍 What Users Love

-

⚙️

Straightforward automation that truly works without intervention

-

💰

No fees for any transactions (deposit, withdrawal, secondary market)

-

📊

Clean, intuitive dashboard with clear performance metrics

-

🛡️

Reliable buyback guarantee that works as promised

👎 Common Complaints

-

⚠️

Limited loan availability causing cash drag during peak times

-

📱

Mobile experience needs improvement for smaller screens

-

📞

Customer support response times can be slow

-

🔍

Lack of manual loan selection options for active investors

Mobile Access

Responsive website design with mobile-friendly interface

Portfolio monitoring on-the-go with account overview and statistics

Some functions limited on smaller screens, including auto-invest setup

Email notifications for important account activities and status changes

Customer Support

Email Support

Primary support channel through info@robocash.me with 18-hour average response time. Most effective for detailed inquiries.

Live Chat

Available during business hours (Mon-Fri, 9am-5pm CET). Best for quick questions and account-specific issues.

Knowledge Base

Comprehensive FAQ section with detailed guides on platform features, account management, and investment processes.

Recent User Reviews

“I’ve been using Robocash for over 2 years now. The truly ‘set and forget’ nature of the platform is what keeps me as a customer. I check my account maybe once a month, and everything just works. Returns have been consistently around 11.5% the entire time. For passive investors, this is probably the best P2P platform available.”

“Great platform for beginners in P2P lending. The automated nature means you don’t need to understand all the details right away. My only complaint is the occasional cash drag where money sits uninvested for a few days. Support is helpful but sometimes slow to respond. Overall, my experience has been positive with consistent returns.”

“The secondary market is a great feature that many don’t talk about. When I needed to access some funds unexpectedly, I was able to sell about €2,000 worth of loans within 48 hours with no fees. That level of liquidity is rare in P2P investing. The buyback guarantee has also worked flawlessly the few times my loans have gone over 30 days late.”

Getting Started

Create Your Account

Register on the Robocash website with your email address, create a password, and agree to the terms of service. The initial registration takes approximately 2 minutes to complete.

Complete Verification

Verify your identity through the KYC (Know Your Customer) process by uploading identification documents and proof of address. This step typically takes 1-2 business days for approval.

Add Funds

Deposit funds to your account using bank transfer or other available payment methods. The minimum investment amount is just €1, though a practical minimum of €100 is recommended for diversification.

Configure Auto-Invest

Set up your auto-invest strategy by specifying investment parameters such as interest rate, loan term, and reinvestment preferences. This configuration will determine how your funds are automatically allocated.

Monitor Your Investment

Once your auto-invest is active, your funds will be automatically invested in loans matching your criteria. You can monitor performance through the dashboard and adjust your strategy if needed.

Account Verification

Personal Information

- ✓ Full legal name as it appears on your ID

- ✓ Date of birth

- ✓ Current residential address

- ✓ Tax identification number

Required Documents

- ✓ Valid government-issued ID or passport

- ✓ Proof of address (utility bill/bank statement from last 3 months)

- ✓ Selfie with your ID document

Deposit Methods

Bank Transfer

Credit/Debit Card

Auto-Invest Configuration Guide

Interest Rate Selection

Set your preferred interest rate range. By default, selecting the maximum rate (currently 11.80%) is recommended to maximize returns.

Loan Term Configuration

Specify your preferred loan term range. Shorter terms (7-30 days) offer quicker capital turnover, while longer terms may provide slightly higher interest rates.

Reinvestment Settings

Choose whether to automatically reinvest principal and interest payments. Enabling reinvestment maximizes compound returns.

Diversification Limits

Set maximum investment amount per loan (minimum €1). Lower amounts increase diversification but may slow down full investment.

ℹ️ Important Information

- All funds are denominated in euros. If depositing in another currency, conversion fees may apply.

- Verification is typically completed within 24 hours during business days but may take longer during peak periods.

- Once auto-invest is configured, no further action is required unless you wish to change your investment parameters.

- While withdrawals are processed within 1-3 business days, invested funds can only be accessed early through the secondary market.

Market Comparison

Platform Comparison

| Feature | Robocash | Mintos | PeerBerry | Esketit |

|---|---|---|---|---|

| Maximum Returns | 11.80% | 12.00% | 12.50% | 14.00% |

| Minimum Investment | €1 | €10 | €10 | €10 |

| Sekundärmarkt | ✓ Free | ✓ Fee-based | ✗ | ✓ Free |

| Rückkauf-Garantie | 30 Tage | 60 days (selected) | 60 Tage | 60 Tage |

| Manual Investing | ✗ | ✓ | ✓ | ✓ |

| Regulation | Croatia (Unregulated) | EU ECSP | Latvia (Unregulated) | Croatia (Unregulated) |

| Operating Since | 2017 | 2015 | 2017 | 2020 |

| Auto-Investieren | ✓ Exclusive | ✓ Optional | ✓ Optional | ✓ Optional |

| Gebühren | None | Secondary market | None | None |

Top Alternatives

Mintos Most Regulated

- ✓ EU ECSP Licensed Platform

- ✓ Manual & Auto Investing

- ✓ Multiple Loan Types

PeerBerry Highest Liquidity

- ✓ 60-Day Buyback

- ✓ Fast Withdrawals

- ✓ Group Guarantee

Esketit Highest Returns

- ✓ Jordan Business Loans

- ✓ Crypto Integration

- ✓ Free Secondary Market

💪 Robocash Strengths vs. Competitors

-

✓

Truly Passive: The only major platform exclusively dedicated to automated investing with no manual option.

-

✓

Lowest Minimum: €1 minimum investment per loan makes it the most accessible for small investors.

-

✓

No Fees: Completely fee-free for all operations, including secondary market transactions.

-

✓

Transparent Structure: All loan originators belong to UnaFinancial Group, providing clear accountability.

⚠️ Robocash Weaknesses vs. Competitors

-

✗

Lower Returns: Maximum return rate of 11.80% is below competitors like Esketit (14.00%).

-

✗

No Manual Investing: Lack of manual loan selection limits control for active investors.

-

✗

Regulatory Status: Less regulatory protection compared to EU ECSP licensed Mintos.

-

✗

Shorter Buyback: 30-day buyback guarantee versus 60 days offered by most competitors.

🔍 Key Differentiators

- Fully Automated Platform: Robocash’s exclusive focus on automation creates a truly “set and forget” investment experience not found elsewhere.

- Integrated Loan Originators: All loans come from within UnaFinancial Group, offering greater transparency than platforms aggregating third-party originators.

- Lowest Entry Barrier: €1 minimum investment per loan makes Robocash the most accessible P2P platform for beginning investors.

- Daily Interest Accrual: Interest calculated and added to account daily rather than monthly, maximizing compound returns.

Market Position & Future Prospects

Robocash has carved out a distinctive position in the European P2P landscape, establishing itself as the specialist in fully automated, passive P2P investments. While not the largest player by volume, the platform has maintained steady growth and carved a loyal niche among investors seeking true “set and forget” investment options.

The platform’s backing by UnaFinancial Group, which reported a turnover of €325.3M in 2021 (a 150% increase from 2020), provides Robocash with financial stability that many independent P2P platforms lack. This integration within a profitable financial group also helps mitigate some of the risks associated with buyback guarantees, as the parent company has demonstrated the financial resources to honor these commitments.

📈 2025 Market Forecast

According to Robocash analysts, the European P2P market is projected to grow by 4.4% in 2025, potentially setting a new historical record since 2019. This growth is expected to be driven primarily by experienced investors rather than newcomers, with forecasts predicting a 16.5% decrease in new market customers compared to 2024.

The average annual market rate is projected to reach 11.64% in 2025 (up from 11.21% at the end of 2024), though analysts suggest that market yields will likely plateau as P2P investments compete with other high-yielding alternative assets.

Robocash’s established position and focus on automation align well with these trends, as experienced investors typically value efficiency and reliability in their P2P investments.

Tax & Reporting

Tax Documents

Annual Income Statement

Comprehensive yearly report showing all interest earned, principal repayments, and transaction history. Available for download as PDF or CSV by January 31st for the previous tax year.

Monthly Account Statement

Detailed monthly summaries of account activity, including investments, returns, and portfolio composition. Available on-demand through the account dashboard.

Transaction Log

Complete chronological record of all account transactions, including investments, interest accrual, principal repayments, and withdrawals. Exportable in CSV format for use with tax software.

Reporting Features

Portfolio Dashboard

Real-time overview of investments with daily updated performance metrics

Export Options

Multiple format exports (PDF, CSV, Excel) for accounting software integration

Custom Date Ranges

Ability to generate reports for specific time periods for tax planning

Email Statements

Optional monthly statements delivered directly to your inbox

Tax Considerations by Region

European Union

- Interest Income: Generally taxed as capital gains or investment income, rates vary by country

- Reporting: Annual tax statements are compatible with most EU tax reporting requirements

- Withholding: No automatic withholding tax is applied; investors must self-declare in their home country

- DAC6: Platform complies with EU Directive on Administrative Cooperation (DAC6) reporting requirements

United Kingdom

- Interest Income: Taxable under Income Tax rules, potentially subject to Personal Savings Allowance

- Reporting: Must be declared on Self Assessment return under “Foreign Interest”

- Foreign Exchange: GBP/EUR exchange rate fluctuations may create additional taxable events

- HMRC: Reports align with HMRC foreign income declaration requirements

International Investors

- Double Taxation: No withholding taxes applied on the platform side to avoid double taxation

- Currency Risk: Investments denominated in euros may create currency gain/loss for tax purposes

- Reporting: Exportable statements compatible with most international tax filing systems

- Local Advice: Local tax professionals should be consulted for jurisdiction-specific requirements

Important Considerations

- • P2P income is generally taxable as interest income in most jurisdictions

- • Secondary market transactions may create capital gains/losses

- • Some countries have specific P2P lending tax classifications

- • Robocash does not provide tax advice or withhold taxes

Tax Efficiency Tips

- • Download annual tax statements promptly after year-end

- • Consider tax implications when timing large withdrawals

- • Track all transactions separately for accurate reporting

- • Explore if P2P investments qualify for tax-advantaged accounts in your jurisdiction

Tax Planning Tools

Annual Tax Simulator

Built-in tool that helps estimate the tax implications of your current investment strategy based on your expected returns.

- Projects annual income based on current portfolio

- Adjustable for different tax rates by country

- Shows before and after-tax return estimates

- Exportable projections for tax planning

Report Scheduler

Feature that allows you to schedule automatic generation and delivery of tax reports at specified intervals.

- Automated monthly, quarterly, or annual reports

- Email delivery in multiple formats (PDF, CSV, Excel)

- Custom date range selection for specific periods

- Support for fiscal year reporting periods

Transaction Categorizer

Tool that helps organize your P2P transactions into appropriate tax categories based on transaction type.

- Distinguishes between interest, principal, and fees

- Separates secondary market capital gains/losses

- Tags transactions by market/country of origin

- Export with categories compatible with tax software

⚠️ Tax Disclaimer

The information provided in this section is for general informational purposes only and should not be considered tax, legal, or financial advice. Tax laws and regulations vary significantly by country and individual circumstances. Robocash does not provide tax consultation services, and investors are strongly advised to consult with qualified tax professionals in their jurisdiction for guidance on their specific situation.

Final Verdict

Key Takeaways

- True “set and forget” platform designed for completely passive P2P investing

- Solid 11-12% returns with consistent performance history since 2017

- 30-day buyback guarantee backed by financially strong parent company

- No investor fees of any kind (deposits, withdrawals, secondary market)

- Limited regulation but transparent corporate structure within UnaFinancial Group

✓ Recommended For

- Investors seeking truly passive income with minimal monitoring

- Those who prefer automation over manual loan selection

- Investors looking for stable, predictable returns (10-12% range)

- Beginners to P2P lending who want a simple entry point

- Medium to long-term investors focused on steady growth

⚠️ Consider Alternatives If

- You prefer hands-on control over individual loan selection

- You require platforms with full regulatory licensing

- You seek the absolute highest returns in P2P (13-14%+)

- You need immediate access to invested capital at all times

- You want diverse loan types beyond consumer lending

Rating Breakdown

| Category | Description | Rating |

|---|---|---|

| Usability | Clean interface, excellent automation features, intuitive dashboard | ★★★★★ 5.0/5.0 |

| Returns | Consistent 11-12% returns, slightly below some competitors | ★★★★ 4.0/5.0 |

| Safety | Strong parent company, 30-day buyback, but limited regulation | ★★★★ 3.8/5.0 |

| Liquidity | Free secondary market, but occasional cash drag issues | ★★★★ 4.0/5.0 |

| Transparency | Clear corporate structure, good reporting, open about risks | ★★★★ 4.2/5.0 |

| Features | Excellent automation, but limited loan selection options | ★★★★ 3.9/5.0 |

| Support | Responsive but sometimes slow customer service | ★★★★ 3.7/5.0 |

| Overall | Excellent platform for passive P2P investing | ★★★★ 4.1/5.0 |

Schlussfolgerung

Robocash delivers precisely what it promises: a truly hands-off P2P investment experience with solid returns. The platform has carved out a distinctive niche in the P2P lending landscape by focusing exclusively on automation and simplicity, making it ideal for investors who prefer a passive approach to generating returns.

The integration within UnaFinancial Group provides a level of transparency and stability that many standalone P2P platforms lack. With its consistent performance since 2017, fee-free structure, and efficient buyback system, Robocash represents a reliable option for investors seeking exposure to consumer loans across multiple markets without the complexity of manual loan selection.

While the platform’s lack of regulatory oversight and slightly lower returns compared to some competitors are notable considerations, these drawbacks are offset by its exceptional ease of use and consistent performance. For investors who value simplicity and passive income over maximum returns or granular control, Robocash remains one of the most compelling options in the European P2P marketplace.

Ready to Start Passive P2P Investing?

📈 Begin earning consistent 11-12% returns today

* Terms and conditions apply. Investment involves risk of capital loss. Past performance does not guarantee future returns. Always conduct your own due diligence before investing.

Listen to Our Robocash Review

Listen to our audio summary of the Robocash review while browsing or on the go. Duration: 2:40

Why listen? Get the key highlights of our in-depth Robocash analysis including returns, risks, and who this platform is best suited for.