As of 2025, savers across Europe are increasingly seeking out flexible savings accounts that offer competitive yields without locking away their funds. Such accounts often come with daily interest payouts, no withdrawal penalties, and low or no minimum deposit requirements—making them especially appealing for those who need quick access to their money while still beating inflation. In this guide, we’ll walk you through how these accounts work, what to look for, and which platforms are currently leading the market.

Introduction: The Rise of Flexible Savings Accounts

European savers face moderate inflation—hovering around 2.2–2.5%—and a shifting interest rate environment driven by central bank policies. Many top digital banks for flexible savings have emerged with competitive daily interest payouts, enabling savers to beat inflation in 2025 without tying up their funds in fixed-term deposits.

While traditional banks have typically offered lower yields, the surge in fintech competition means that even well-established institutions are revisiting their product offerings. As a result, flexible savings accounts—often with no minimum deposit and no withdrawal penalties—have become a popular go-to for both new and seasoned savers.

Key Features of a Flexible Savings Account

- Daily (or Frequent) Interest Payouts

- Unlike fixed-term accounts that may only credit interest monthly or annually, flexible savings accounts often compound daily and add earnings to your balance regularly.

- No Withdrawal Penalties

- You can typically withdraw or transfer your money anytime without incurring fees or losing accumulated interest—ideal for emergency funds or short-term goals.

- Low (or No) Minimum Deposits

- Many neobanks and fintech platforms allow you to open an account with as little as EUR 0 to EUR 10, lowering barriers to entry.

- User-Friendly Mobile Apps

- Most top digital banks for high-interest savings Europe offer intuitive features like real-time balance updates, budgeting tools, and instant notifications.

- Regulatory Protections

- Look for FSCS protected flexible accounts in the UK or EU deposit insurance in Eurozone countries (up to EUR 100,000), ensuring peace of mind if the bank fails.

What to Consider Before Opening a Flexible Savings Account

- Interest Rates vs. Inflation

- Aim for yields above 2.5% (current inflation estimates) to protect your purchasing power. Some banks offer promotional rates that adjust after a few months—always check the post-promo APY.

- Withdrawal & Transfer Speeds

- Even if there are no penalties, some platforms may take 1–2 days to process withdrawals. If instant access is crucial, confirm the bank’s processing times.

- Fees & Charges

- Beware of hidden fees, such as monthly service fees, ATM withdrawal charges, or exchange rate markups if you plan to hold multi-currency savings.

- Multi-Currency Support

- If you earn income or make purchases in multiple currencies, a multi-currency flexible savings feature can save you from costly foreign exchange charges.

- Customer Service

- Neobanks typically rely on in-app chat or email support. Make sure you’re comfortable with the available support channels before committing.

Top Flexible Savings Accounts in Europe 2025

Below, we highlight five standout flexible savings accounts that offer daily interest payouts, no withdrawal penalties, and competitive rates as of January 2025. Each includes key features, pros, cons, and a quick guide on how to get started.

1. Revolut Flexi Save

Short Introduction

Revolut’s multi-currency features and user-friendly app have made it a go-to for cross-border users. The new “Flexi Save” feature offers daily-compounded interest for those looking to keep funds accessible.

- Wesentliche Merkmale

- Interest Rate: Up to 3.00% APY (varies by subscription tier and country)

- Minimum Deposit: EUR 1

- Withdrawal Terms: Instant access; no penalties

- Regulatory Coverage: Partial deposit protection via partner banks

Profis

- Multi-currency support

- Real-time notifications and spending analytics

- Competitive rate for a daily interest account

Nachteile

- Higher tiers often require paid subscriptions (e.g., Premium or Metal)

- Regional differences in coverage and available features

Best For

Frequent travelers, gig workers, and anyone needing immediate, global access to their funds.

Unique Selling Point

Revolut’s integrated ecosystem lets you manage multiple currencies, track expenses, and earn daily interest—ideal for modern, on-the-go lifestyles.

How to Get Started

- Download the Revolut App: Complete sign-up and KYC.

- Open a Flexi Save Vault: Deposit as little as EUR 1.

- Monitor Daily Interest: Check real-time updates on accrued interest.

2. N26 Flexible Space

Short Introduction

Berlin-based N26 pioneered mobile banking in Europe, boasting a minimalist interface and transparent fee structure. Its “Flexible Space” account offers variable but attractive rates, with instant access.

- Wesentliche Merkmale

- Interest Rate: Up to 2.80% APY

- Minimum Deposit: EUR 0

- Withdrawal Terms: Instant or same-day; no fees

- Regulatory Coverage: FSCS-equivalent in Germany (up to EUR 100,000)

Profis

- No minimum deposit—start saving immediately

- Budget-friendly interface with “Spaces” for categorized saving goals

- Swift, seamless app experience

Nachteile

- Higher rates sometimes available only for a limited promotional period

- Fee-free ATM withdrawals are limited for standard users

Best For

New savers, students, and anyone wanting a simplified, no-fuss mobile banking experience.

Unique Selling Point

N26’s easy-to-use interface and “Spaces” feature enable you to create multiple mini-savings pockets for different goals, each earning interest independently.

How to Get Started

- Download the N26 App: Sign up and confirm identity via video or ID upload.

- Create a Flexible Space: Name it (e.g., “Vacation Fund”).

- Fund & Earn: Deposit any amount—no minimum required.

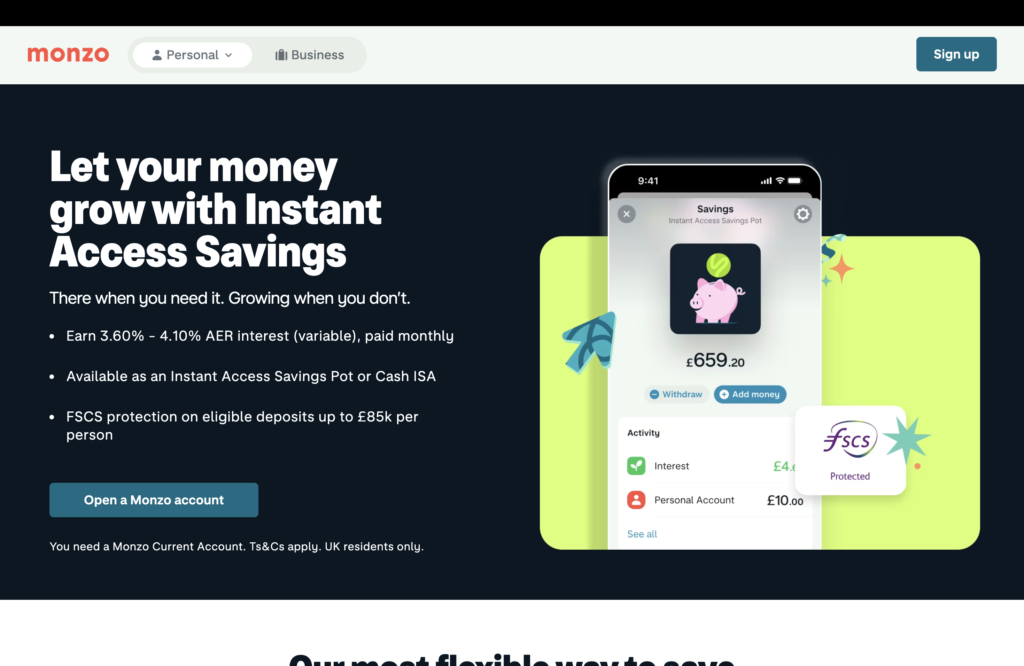

3. Monzo Instant Access Savings

Short Introduction

A UK-based digital bank, Monzo is renowned for its bright coral debit cards and intuitive budgeting tools. Its Instant Access Savings account aligns with the brand’s ethos of transparency and convenience.

- Wesentliche Merkmale

- Interest Rate: Up to 2.90% APY

- Minimum Deposit: GBP 1 (approx. EUR 1.15)

- Withdrawal Terms: Near-instant transfers to main Monzo account

- Regulatory Coverage: FSCS protected flexible account (GBP 85,000)

Profis

- Highly user-friendly app with real-time spending breakdowns

- Strong community support and frequent feature updates

- Round-up feature helps incrementally grow savings

Nachteile

- Primarily UK-focused; EU residents need to check availability

- Currency conversion fees may apply for non-GBP transactions

Best For

UK residents who want a fuss-free savings option integrated into a popular digital banking service.

Unique Selling Point

Monzo’s instant transfers between the savings account and the primary current account ensure you can deploy funds whenever you need them—perfect for unexpected expenses.

How to Get Started

- Open a Monzo Account: Registration requires a UK address and valid ID.

- Tap “Savings”: Select the Instant Access pot.

- Choose Deposit Amount: Even GBP 1 suffices. Earn daily interest from Day One.

4. Starling Daily Saver

Short Introduction

Another UK digital bank, Starling, emphasizes robust budgeting tools and round-the-clock customer support. Its Daily Saver product focuses on high accessibility and daily compounding.

- Wesentliche Merkmale

- Interest Rate: Up to 3.00% APY

- Minimum Deposit: GBP 1 (approx. EUR 1.15)

- Withdrawal Terms: Instant transfers to Starling current account

- Regulatory Coverage: FSCS protection (GBP 85,000)

Profis

- Award-winning customer service

- Real-time transaction alerts, easy bill splitting

- Allows unlimited “Spaces” for earmarked savings

Nachteile

- UK residency required for primary account setup

- Fewer currency exchange features compared to Revolut

Best For

Users who value seamless budgeting tools, strong customer support, and immediate fund access in the UK context.

Unique Selling Point

Starling’s daily compounding seamlessly integrates with its broader budgeting ecosystem, ensuring every penny works harder for you.

How to Get Started

- Download the Starling Bank App: Register with ID and a UK address.

- Open Daily Saver: Move funds from your current account within seconds.

- Earn & Monitor: Watch your savings balance update daily with accrued interest.

5. Bunq Freedom Account

Short Introduction

A Netherlands-based neobank, Bunq is lauded for its eco-friendly approach, multiple IBANs, and high customization. The Bunq Freedom Account expands on this ethos with daily interest and flexible features.

- Wesentliche Merkmale

- Interest Rate: Up to 2.75% APY

- Minimum Deposit: EUR 0

- Withdrawal Terms: Same-day SEPA transfers

- Regulatory Coverage: Up to EUR 100,000 under Dutch deposit guarantee

Profis

- In-app options for sustainability projects (planting trees, green investments)

- Multiple sub-accounts with individual IBANs

- Immediate transparency on fees, interest, and eco-impact

Nachteile

- Some advanced features require a paid subscription tier

- Slightly lower headline APY compared to others (though daily interest still competitive)

Best For

Eco-conscious savers and digital nomads who value customization and multi-IBAN capabilities within a single app.

Unique Selling Point

Bunq merges daily interest with eco-friendly features, letting you track your personal or business finances while supporting environmental causes.

How to Get Started

- Register on the Bunq App: Complete KYC and choose a plan (Free, Premium, Business).

- Open a Freedom Sub-Account: No minimum deposit required.

- Customize: Set your saving goals, track tree-planting milestones, and watch daily interest accumulate.

Comparison Table: Flexible Savings in Europe

| Plattform | Interest Rate | Min. Deposit | Withdrawal Terms | Coverage | Best For |

|---|---|---|---|---|---|

| Revolut Flexi Save | Up to 3.00% APY | EUR 1 | Instant | Partial partner bank coverage | Cross-border, multi-currency users |

| N26 Flexible Space | Up to 2.80% APY | EUR 0 | Instant / same-day | German Deposit Guarantee (EUR 100K) | Beginners, minimal deposit |

| Monzo Instant Access | Up to 2.90% APY | GBP 1 | Near-instant | FSCS (GBP 85K) | UK residents, daily budgeting |

| Starling Daily Saver | Up to 3.00% APY | GBP 1 | Instant | FSCS (GBP 85K) | UK users wanting top-tier app & support |

| Bunq Freedom Account | Up to 2.75% APY | EUR 0 | Same-day SEPA | Dutch Deposit Guarantee (EUR 100K) | Eco-conscious users & multi-IBAN needs |

Calculate potential earnings with flexible savings accounts

Frequently Asked Questions (FAQs)

- Are flexible savings accounts safe?

Yes—if the bank is licensed and covered by a national deposit protection scheme. Look for FSCS protection in the UK or the equivalent EUR 100,000 coverage in EU countries. - How do flexible savings accounts differ from fixed-term savings?

Flexible accounts allow daily or on-demand withdrawals without penalties, whereas fixed-term savings lock in your funds for a set period in exchange for typically higher interest. - Do I earn less interest with a flexible account compared to a fixed-term deposit?

Historically, yes. But with today’s competitive fintech landscape, flexible accounts can offer rates close to or even matching some fixed-term deals—especially with promotions. - Can I open multiple flexible savings accounts to diversify?

Absolutely. Splitting your funds across different banks can help you leverage various promotional rates and keep each balance under deposit insurance limits. - Is there a difference in daily vs. monthly interest compounding?

Daily compounding slightly increases your effective annual yield, as your interest earns interest more frequently. Monthly compounding is still common, so always check the compounding frequency. - What if I’m not a resident of the bank’s country?

Many neobanks (e.g., Revolut, N26, Bunq) allow cross-border or expat sign-ups if you hold an EU address. UK-based banks like Monzo and Starling typically require UK residency. - Are there fees for depositing or withdrawing?

Generally, no. But watch for potential currency conversion fees if you’re depositing in another currency or transferring outside the bank’s network. - Do these accounts offer multi-currency options?

Revolut is a standout for multi-currency wallets. Bunq also provides multi-IBAN solutions. N26 largely focuses on Euros, while UK banks Monzo and Starling focus on GBP. - Can I integrate these savings accounts with other financial tools?

Yes—most digital banks support standard payment networks. Many also integrate with budgeting apps, personal finance platforms, or offer in-app “Spaces” or “Pots.” - How often do interest rates change?

Rates can shift based on market conditions or internal bank promotions. Turn on app notifications or subscribe to bank email updates for real-time alerts.

Conclusion: How to Make the Most of Flexible Savings

Flexible savings accounts provide an excellent balance between accessibility and inflation-beating returns. With daily interest payouts, zero or minimal withdrawal penalties, and coverage from deposit insurance schemes, these accounts are ideal for managing an emergency fund, saving for short-term goals, or simply earning more than a standard checking account.

Action Steps to Optimize Your Flexible Savings

- Compare Current Rates

- If your existing account yields below 2% APY, consider switching to any of the featured accounts above.

- Open Multiple Accounts

- Diversify your savings to take advantage of promotional rates and keep each balance within deposit insurance limits.

- Leverage Automation

- Set up automatic transfers to your flexible savings account right after each paycheck to ensure regular contributions.

- Monitor Economic Changes

- Stay updated on ECB or Bank of England interest rate announcements, as these can prompt banks to adjust their APYs.

- Review Yearly

- Rates and terms can fluctuate. Evaluate your account at least once a year to see if better deals have emerged.

With a strategic approach to flexible savings—combining daily compounding, zero penalties, and user-friendly digital platforms—you can effectively beat inflation in 2025 and keep your funds readily accessible for any financial curveballs life may throw. Alternatively read our article about high yield savings accounts.