In 2025, crypto savings accounts have become a mainstream avenue for earning passive income on your digital assets. Offering anywhere from 0.02% to over 15% APY, these platforms provide an enticing alternative to traditional savings accounts—though they also come with unique risks. This guide will walk you through the top crypto savings platforms, the factors to consider when choosing one, and the potential pitfalls to keep in mind.

Why Consider Crypto Staking?

As decentralized finance (DeFi) and centralized crypto platforms continue to evolve, crypto savings accounts have emerged as a way to earn yield on idle assets. From stablecoins like USDC and PYUSD to blue-chip cryptocurrencies like Bitcoin and Ethereum, these platforms often advertise higher rates than traditional banks. Some even surpass 15% APY on select tokens or under promotional programs.

However, it’s crucial to remember that higher returns usually come with higher risk. Unlike conventional savings accounts, crypto deposits usually lack government-backed insurance (e.g., FDIC or FSCS). Market volatility, regulatory shifts, and platform solvency all play significant roles in determining the reliability of the yield.

Factors to Consider Before Opening a Crypto Savings Account

- Interest Rates

- Compare APYs offered for each asset. Some platforms pay more on crypto staking for stablecoins, while others focus on altcoins.

- Check if rates are tiered (e.g., higher APY for larger balances).

- Security Measures

- Look for cold storage, multi-signature wallets, and third-party audits.

- Platforms partnered with reputable custodians or backed by insurance (even partially) typically indicate lower custodial risk.

- Supported Cryptocurrencies

- Ensure the platform supports the coins or tokens you plan to deposit.

- Some cater primarily to stablecoins, while others have extensive altcoin and DeFi token options.

- Withdrawal Terms

- Check if the platform allows flexible withdrawals or if it locks up funds for a term.

- Understand withdrawal fees and wait times, especially for large sums.

- Geographical Availability

- Certain platforms restrict or disallow customers from specific countries (e.g., the U.S.) due to regulations.

- Confirm your eligibility before signing up.

- Platform Reputation & Longevity

- Platforms that have weathered market fluctuations and maintained consistent payouts tend to be more trustworthy.

- Read user reviews, look for transparent leadership, and verify compliance with local laws.

Top Crypto Savings Platforms in 2025

Below are nine standout platforms, each with its own strengths and target audience. Use this overview as a starting point, but always do additional research before committing funds.

1. Coinbase

Key Features

- Interest Rate: Up to 4.10% APY on USDC

- Supported Assets: Primarily USDC for yield, with other features for mainstream cryptos

- Withdrawal Terms: Flexible, instant access for USDC holdings

- Geographical Availability: U.S.-based customers (with some international services)

- Platform Reputation: One of the most recognized and compliant exchanges

Pros

- Strong regulatory standing in the U.S.

- Simple user interface, suitable for beginners

- Transparent fee structure

Cons

- Limited yield options beyond USDC

- Not available in every country

- Generally lower APYs compared to more specialized platforms

Best For

U.S.-based retail investors seeking a straightforward way to earn interest on stablecoins.

Unique Selling Point

Coinbase’s robust reputation and user-friendly approach make it one of the safest bets for newcomers to crypto savings.

How to Get Started

- Sign Up: Create an account, verify your ID.

- Fund with USDC: Convert fiat or transfer crypto into USDC.

- Enable Interest: Earn up to 4.10% APY automatically on eligible balances.

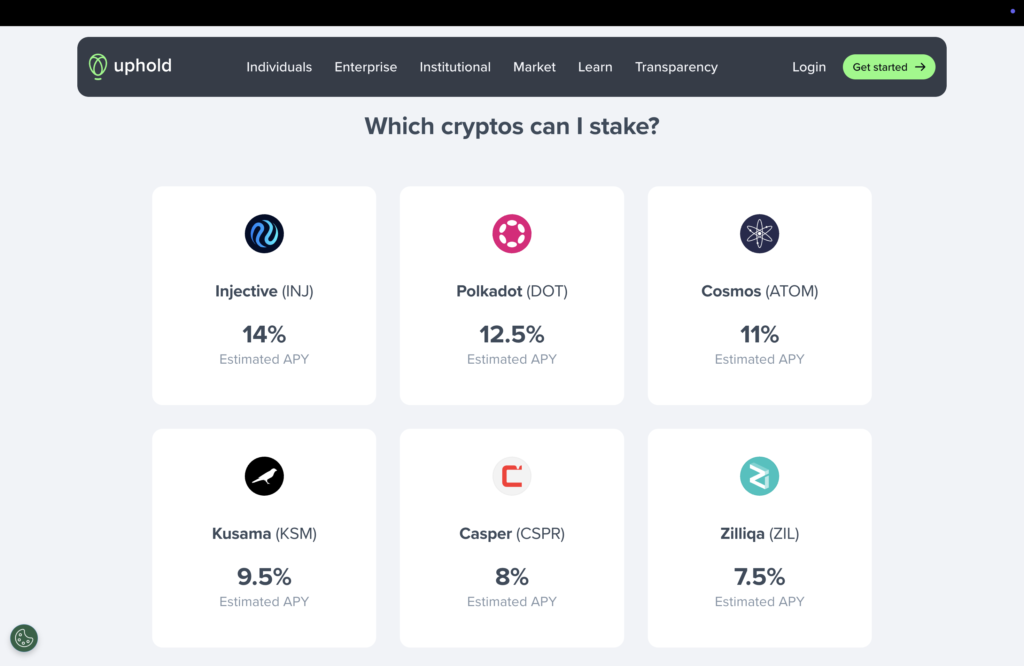

2. Uphold

Key Features

- Interest Rate: Up to 14% APY on select cryptos, including 5% on USDC/PYUSD

- Withdrawal Terms: Mostly flexible; some lock-up periods for staking

- Geographical Availability: Services vary by region; no staking for U.S. customers currently

- Platform Reputation: Known for multi-asset support, including metals and equities

Pros

- Wide variety of assets (crypto, stocks, metals) in one platform

- Competitive yields on select tokens

- Transparent interface with real-time asset tracking

Cons

- U.S. staking recently discontinued

- Staking yields can vary widely and may require lock-ups

- Platform fees can be opaque for certain features

Best For

International users who want to hold multiple asset classes in one account and earn on top cryptos or stablecoins.

Unique Selling Point

Uphold’s multi-asset ecosystem allows cross-asset conversions, letting users diversify beyond just crypto while still earning yields.

How to Get Started

- Register: Provide email, set up 2FA, complete KYC.

- Deposit Assets: Transfer or buy crypto/stablecoins.

- Select Staking/Yield Options: Choose which assets to stake or hold for daily interest accrual.

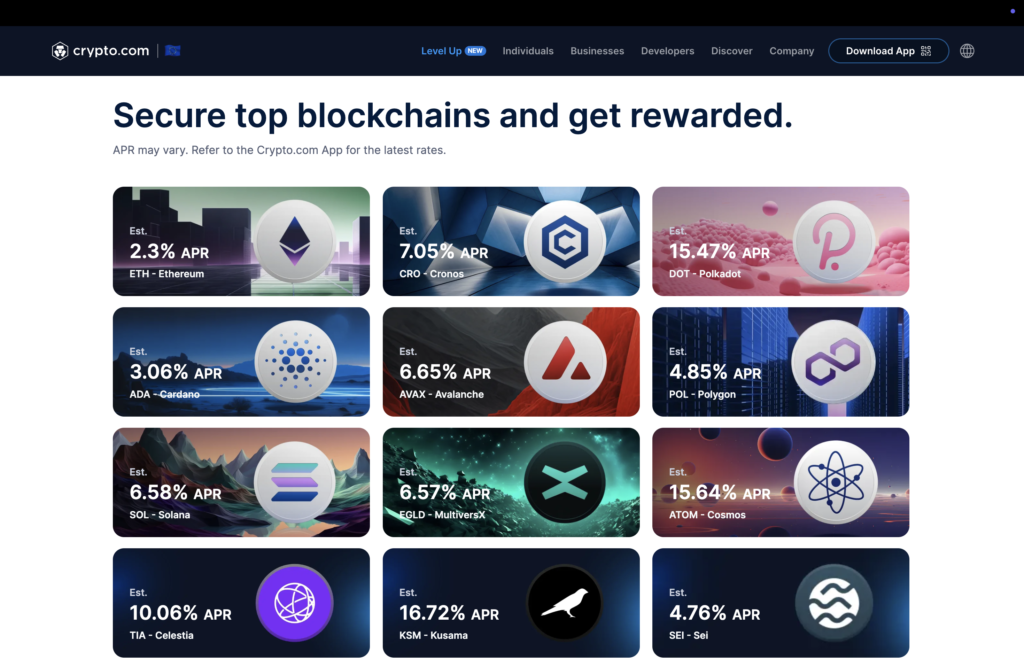

3. Crypto.com

Key Features

- Interest Rate: Up to 15% on certain assets

- Supported Assets: 15 major cryptos, 8 stablecoins

- Withdrawal Terms: Can vary—flexible, 1-month, or 3-month lock-up periods

- Platform Reputation: Known for aggressive marketing, debit cards, and NFT marketplace

Pros

- Some of the highest advertised yields in the market

- Integrated debit card with crypto rewards

- User-friendly app with robust trading features

Cons

- Highest rates often require staking CRO tokens

- Lock-up periods may penalize early withdrawals

- Tiers and promotions can be complex for new users

Best For

Crypto enthusiasts comfortable with staking the platform’s native token (CRO) for extra benefits.

Unique Selling Point

An all-in-one ecosystem—trading, debit cards, and NFT marketplace—allows users to manage multiple financial services under one roof.

How to Get Started

- Download Crypto.com: Create an account and pass KYC.

- Stake CRO (Optional): Unlock higher APYs by holding CRO.

- Choose Savings Tier: Flexible or locked terms to start earning interest on supported cryptos.

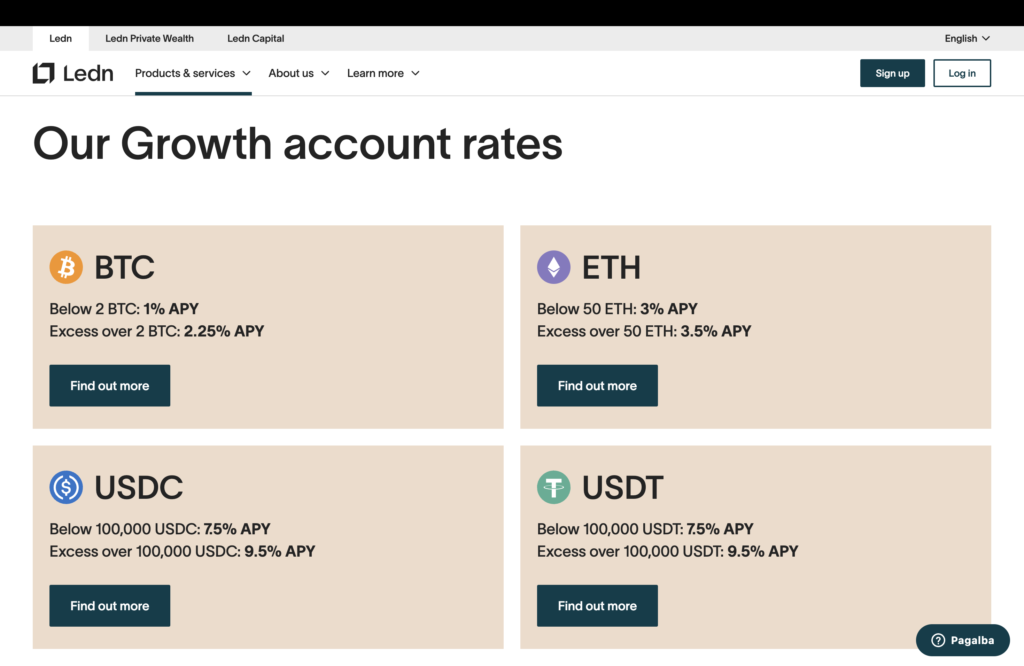

4. Ledn

Key Features

- Interest Rate: Tiered rates:

- USDC: 7.5% interest up to 100,000 USDC, 9.5% above that

- Bitcoin: 1.00% for up to 2 BTC, 2.25% for balances over 2 BTC

- Supported Assets: Primarily BTC and USDC

- Withdrawal Terms: Usually flexible, with optional loans

- Platform Reputation: Transparent, focused approach on a small number of assets

Pros

- Clear tiered system that rewards large balances

- Specialized in BTC and USDC; simpler for those with a focused portfolio

- Offers Bitcoin-backed loans for liquidity without selling your BTC

Cons

- Limited asset support (no altcoins beyond BTC, USDC)

- Rates on BTC can be lower than other platforms

- Geographic restrictions for some lending features

Best For

Investors concentrating on Bitcoin and USDC who want straightforward, tiered interest without diving into multiple altcoins.

Unique Selling Point

Ledn’s specialization in just two core assets (BTC and USDC) allows competitive returns and a user experience tailored to these holdings.

How to Get Started

- Open an Account: Verify your ID and complete KYC.

- Deposit BTC or USDC: Choose the tier that matches your balance.

- Track Interest: Earn automatically, with interest compounding at set intervals.

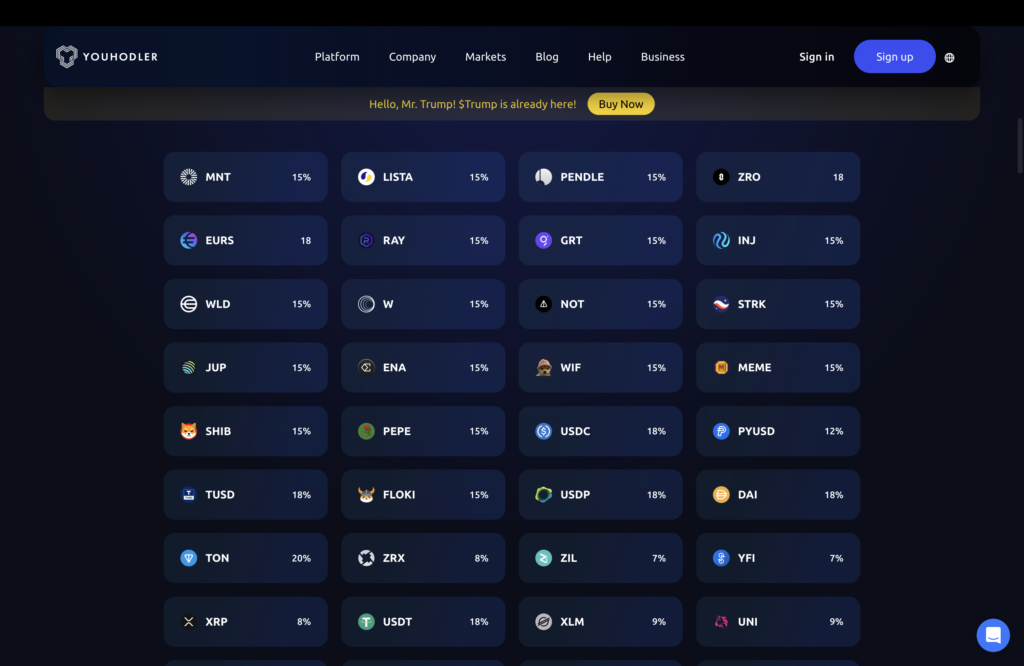

5. YouHodler

Key Features

- Interest Rate: Up to 15% p.a. on major cryptos/stablecoins

- Supported Assets: Over 50 cryptos and stablecoins (BTC, ETH, USDT, USDC, etc.)

- Withdrawal Terms: Generally flexible, no minimum deposit

- Platform Reputation: Known for high-yield offerings and “Multi-HODL” leveraged product

Pros

- Wide range of coins, including niche altcoins

- No minimum deposit, making it accessible to small-scale investors

- “Multi-HODL” feature can enhance potential gains (at higher risk)

Cons

- Higher yields come with higher market risk

- Advanced features like Multi-HODL might overwhelm beginners

- Fees for certain transactions can be relatively high

Best For

Users who want to explore multiple crypto assets beyond major players and earn above-average yields.

Unique Selling Point

High APYs across a broad asset roster, plus leveraged products for those who want more than simple savings.

How to Get Started

- Sign Up: Register and pass KYC on YouHodler’s platform.

- Deposit Desired Assets: Choose from a wide variety of cryptos or stablecoins.

- Select Savings or Multi-HODL: Earn passive interest or explore leveraged yields for higher potential returns.

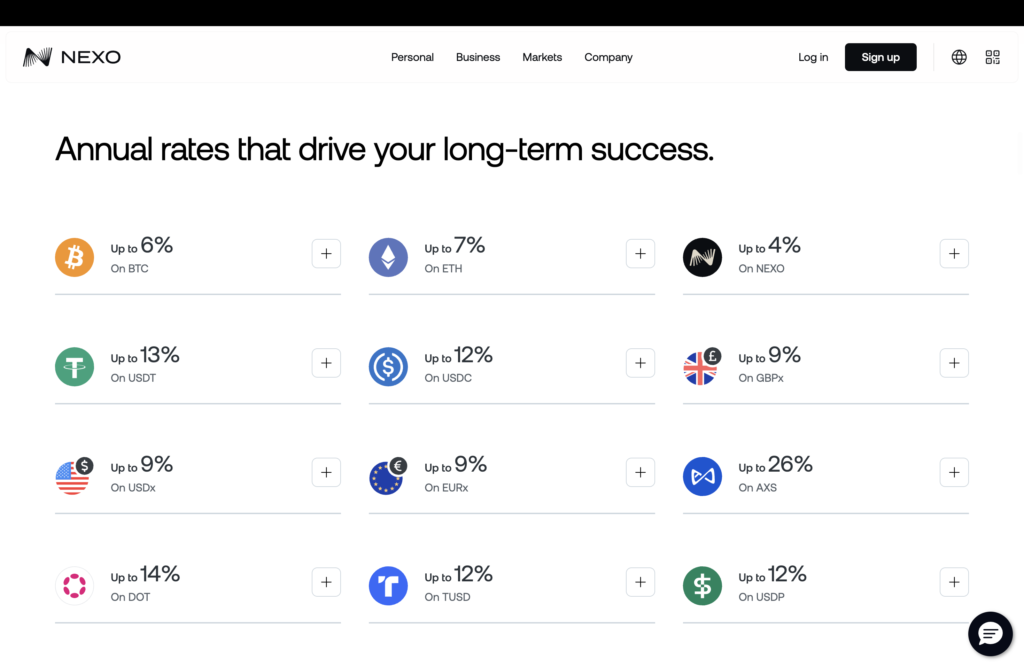

6. Nexo

Key Features

- Interest Rate: Up to 16% interest on crypto assets, depending on loyalty tier

- Supported Assets: Multiple cryptos and stablecoins (BTC, ETH, USDC, etc.)

- Withdrawal Terms: No lock-up periods; flexible interest payouts

- Platform Reputation: One of the earliest and most recognized CeFi lenders

Pros

- No deposit/withdrawal fees in most cases

- Tiered loyalty program enhances interest rates

- Daily interest payouts for certain assets

Cons

- Holding NEXO tokens can be complex if you’re just seeking passive yields

- Rates vary widely by asset and loyalty tier

- Marketable reputation but not always the highest base rates without token staking

Best For

Mid-level or advanced crypto users looking for a balanced, flexible solution with daily interest options and no forced lock-ups.

Unique Selling Point

Nexo’s all-in-one platform includes borrowing, trading, and saving, making it easy to manage various crypto-related financial needs in one account.

How to Get Started

- Create a Nexo Account: Submit KYC documents.

- Fund with Crypto/Stablecoins: Earn interest right away on supported assets.

- Consider NEXO Tokens: Holding them can boost your APY if you meet loyalty-tier requirements.

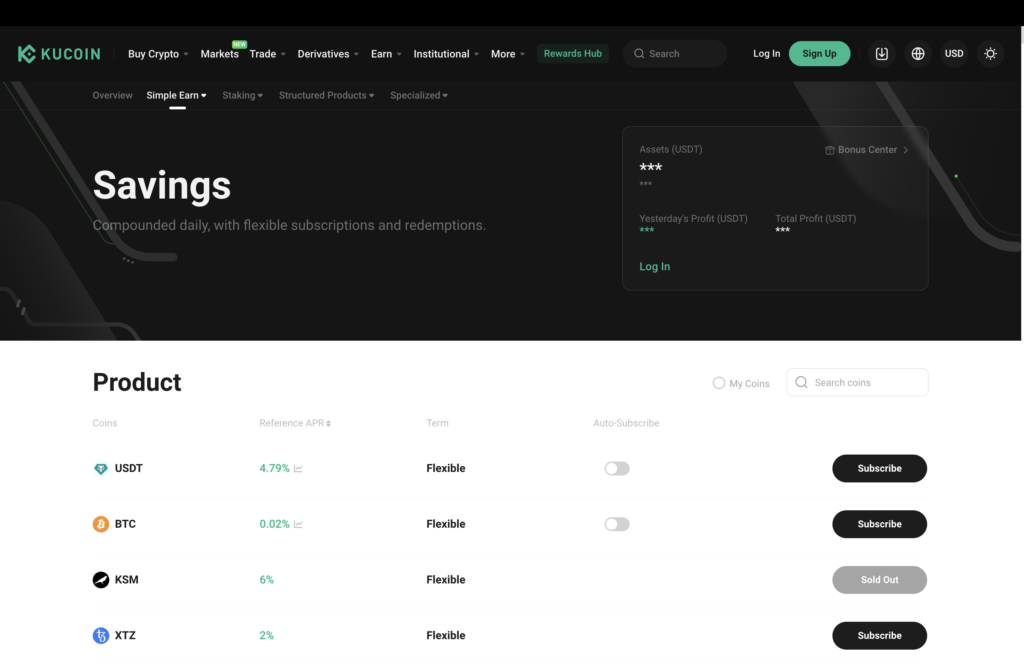

7. KuCoin

Key Features

- Interest Rate: 2.01% on USDC, 0.02% on BTC, with higher promotional rates on specific assets

- Supported Assets: Wide range, from mainstream to low-cap altcoins

- Withdrawal Terms: Flexible savings, staking, and periodic promotional offers

- Platform Reputation: Known as an “altcoin haven” with active trading features

Pros

- Frequent promotional APYs for emerging tokens

- Robust trading ecosystem and advanced order types

- Often among the first to list new coins

Cons

- Some yields (especially on BTC, USDC) are lower than competitors

- Regulatory status can vary by region; approach with caution if local laws are unclear

- Staking promotions may have limited-time windows

Best For

Altcoin traders wanting a single platform for both earning yield and actively trading lesser-known tokens.

Unique Selling Point

KuCoin Earn’s flexibility in combining staking, saving, and other yield-generating offers can be appealing to those who like to rotate assets between liquidity programs.

How to Get Started

- Open KuCoin: Complete account setup and KYC (if required in your region).

- Explore KuCoin Earn: Choose from staking, flexible savings, or promotional events.

- Deposit Assets: Transfer crypto to start earning interest.

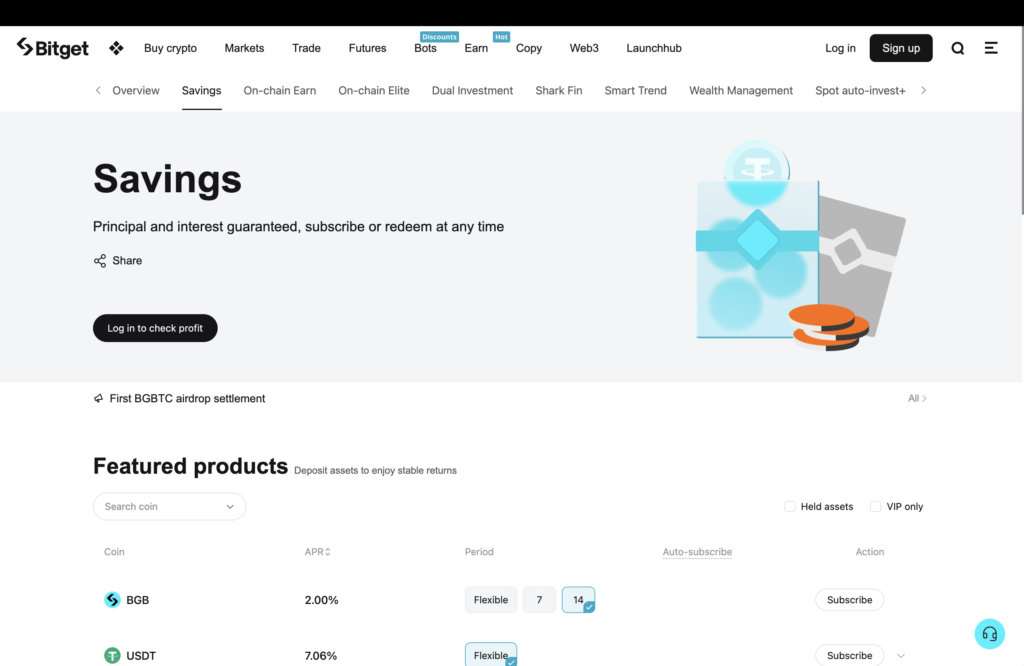

8. Bitget

Key Features

- Interest Rate: Competitive, with both fixed and flexible options (exact rates vary)

- Supported Assets: Wide range of major and mid-cap cryptos

- Withdrawal Terms: Users can pick durations; flexible, 7-day, or monthly lock-ups

- Platform Reputation: Rapidly growing exchange with derivatives, copy trading, and an “Earn” program

Pros

- Choice between flexible savings and locked-term deposits

- Active user community and social trading features

- Emerging track record with frequent upgrades

Cons

- Relatively new to the yield space compared to established lenders

- Need to check each coin’s APY and lock-up terms individually

- May have limited availability in certain jurisdictions

Best For

Crypto investors seeking a balance of short-term flexibility and higher locked-term rates, plus an interest in derivatives or copy trading.

Unique Selling Point

Bitget’s Earn program integrates well with its broader ecosystem, allowing investors to pivot between trading and saving as market conditions shift.

How to Get Started

- Register on Bitget: Provide KYC documents where required.

- Check ‘Earn’ Tab: See current APYs for flexible and locked options.

- Deposit Funds: Choose your preferred asset and lock-up duration.

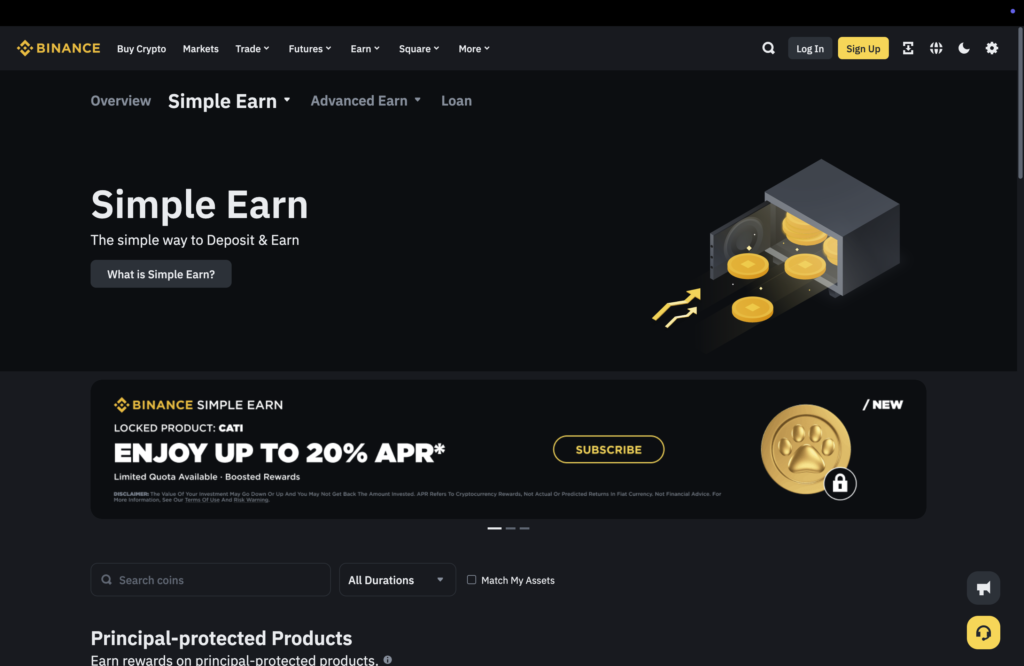

9. Binance

Key Features

- Interest Rate: Varies widely; flexible and locked saving, staking, liquidity farming

- Supported Assets: Massive selection of cryptos, from major to niche

- Withdrawal Terms: Dependent on product type (flexible vs. locked vs. farm)

- Platform Reputation: One of the largest crypto exchanges globally

Pros

- Extensive range of earning options (staking, lending, liquidity pools)

- Liquidity and trading depth among the highest in the industry

- Frequent promotional events featuring elevated APYs

Cons

- Interface can be overwhelming for newcomers

- Some products are region-restricted or no longer available in certain markets

- Customer support can be slow during high-traffic periods

Best For

Experienced crypto users who want a wide variety of earning strategies, from straightforward savings to complex yield farming.

Unique Selling Point

The sheer number of products—flexible savings, locked savings, launchpad, DeFi staking—makes Binance a one-stop shop for those comfortable navigating complexity.

How to Get Started

- Open a Binance Account: Verify your identity if KYC is mandatory in your jurisdiction.

- Go to ‘Earn’: Browse flexible savings, locked staking, or farming pools.

- Transfer Crypto: Choose your preferred approach and deposit funds accordingly.

Risks and Considerations

While the interest rates can be enticing, crypto savings are not without potential downsides. Keep these risks in mind:

- Market Volatility

- Token prices can fluctuate wildly, affecting the value of your holdings even if you earn interest in the same token.

- Regulatory Uncertainty

- Crypto regulations differ by country. Platforms can suddenly restrict services based on shifting legal frameworks.

- Platform Risk

- If an exchange or lending platform faces liquidity issues or hacks, your assets may be at stake, with limited or no insurance.

- Changing Terms & Conditions

- Rates and programs can be revised quickly. Always read updates from your platform to stay aware of changes.

- Lock-Up Periods

- Some yields require you to commit your funds for a set time, limiting your ability to respond to market shifts.

- Diversification

- Keeping all your crypto in one platform is risky. Distribute funds across multiple accounts—or consider a mix of hot, cold, and hardware wallets—for better security.

Conclusion: Making the Most of Crypto Savings Accounts

Crypto savings accounts offer a potentially rewarding way to grow digital assets, whether you’re holding stablecoins for predictable yields or speculative altcoins for higher APYs. As with any financial venture, due diligence is crucial. Compare interest rates, read user reviews, and stay updated on regulatory changes in your region.

Steps to Get Started Safely

- Pick a Reputable Platform

- Test with a Small Amount

- Dip your toes in with a modest deposit and see how interest accrues and how the withdrawal process works.

- Stay Informed

- Join community forums, follow official Twitter or Telegram channels, and subscribe to email alerts to track potential changes.

- Diversify Across Platforms

- Spread your assets among multiple providers to reduce platform risk.

- Monitor Market Conditions

- Crypto is inherently volatile. If markets swing dramatically, be prepared to adjust or withdraw your funds.

By keeping these guidelines in mind, you can navigate the world of crypto savings with greater confidence—earning competitive yields while managing the inherent risks of this fast-evolving financial frontier. Remember, past performance doesn’t guarantee future results, and interest rates can change rapidly, so always stay vigilant and proactive in managing your crypto portfolio.