Introduction

Peer-to-peer (P2P) lending has revolutionized the investment landscape in Greece, offering individuals an innovative way to earn attractive returns. This article is designed to help you navigate the best P2P lending platforms in Greece for 2025, providing clear, easy-to-understand information. Whether you’re a novice or an experienced investor, this guide will help you make informed decisions.

Top 5 Platforms for European Investments in 2025:

- Esketit – best platform for diversified European investments.

- Hive5 – high-yield P2P lending platform in Europe.

- PeerBerry – trusted platform with a wide range of investment opportunities in Europe.

- Mintos – largest European P2P marketplace for diversified investment options.

- Crowdpear – easy-to-use platform for investing in European real estate and projects.

What is P2P Lending?

Definition of P2P Lending

P2P lending is a financial technology that connects borrowers directly with investors through online platforms. It cuts out traditional financial institutions, often resulting in better interest rates for both parties.

How P2P Lending Works

- Borrowers apply for loans through P2P platforms.

- Investors fund these loans, either fully or partially.

- Platforms facilitate the transactions, handling payments and collections.

Benefits of P2P Lending

For Investors: Higher potential returns compared to traditional savings.

For Borrowers: Easier access to funds with competitive interest rates.

Risks Associated with P2P Lending

- Default Risk: Borrowers might not repay their loans.

- Liquidity Risk: Investments can be harder to withdraw quickly.

- Platform Risk: The platform could go out of business.

Best P2P Lending Platforms in Greece for 2025

1. Esketit

Esketit stands out for its user-friendly interface and diverse loan offerings, making it one of the best P2P lending platforms in Greece.

Key Features and Benefits

- Offers various loan types, including personal and business loans.

- Competitive interest rates.

- Robust user interface and excellent customer support.

Loan Types and Investment Options

Esketit provides personal loans, business loans, and payday loans, offering various options for investors.

Minimum Investment and Expected Returns

- Minimum Investment: €10

- Expected Returns: Up to 12%

User Experience and Customer Support

Esketit provides a seamless user experience with responsive customer support.

Pros & Cons

Pros:

- High returns.

- Low minimum investment.

- User-friendly platform.

- Strong customer support.

Cons:

- Limited loan types.

- Regional restrictions.

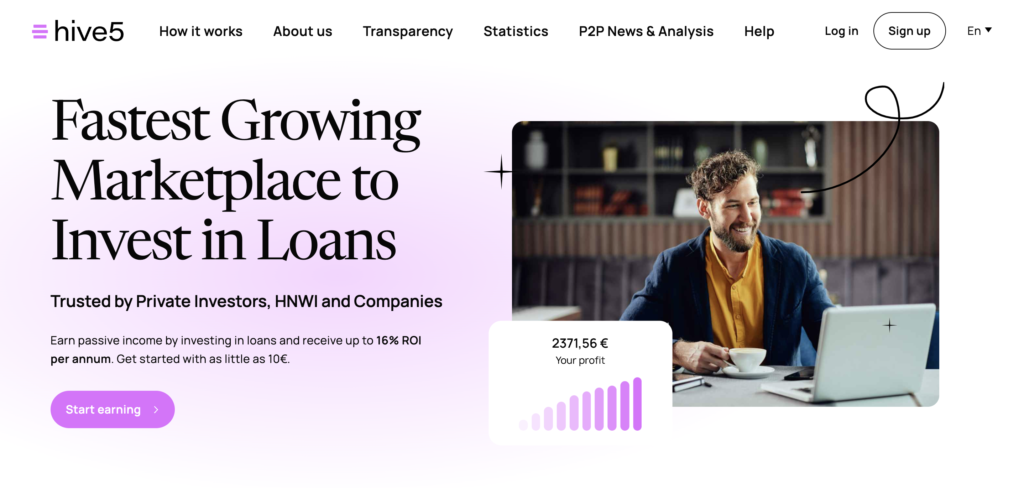

2. Hive5

Hive5 is known for its innovative approach and excellent customer support, positioning it as a top choice among the best P2P lending platforms in Greece.

Key Features and Benefits

- Wide range of loan types.

- Strong risk management tools.

- Transparent fee structure.

Loan Types and Investment Options

Hive5 provides personal loans, SME loans, and real estate loans, catering to diverse investment preferences.

Minimum Investment and Expected Returns

- Minimum Investment: €50

- Expected Returns: 10-15%

User Experience and Customer Support

Hive5 offers a user-centric interface and dedicated customer service.

Pros & Cons

Pros:

- High returns.

- Diverse loan portfolio.

- Effective risk management.

Cons:

- Higher minimum investment.

- Fees may be higher than some competitors.

3. PeerBerry

PeerBerry is renowned for its stability and consistent returns, making it a reliable platform and one of the best P2P lending platforms in Greece for both new and experienced investors.

Key Features and Benefits

- Offers secured loans.

- High transparency.

- Excellent track record.

Loan Types and Investment Options

PeerBerry offers personal loans, business loans, and short-term loans with buyback guarantees, ensuring a range of secure investment opportunities.

Minimum Investment and Expected Returns

- Minimum Investment: €10

- Expected Returns: 9-12%

User Experience and Customer Support

PeerBerry provides a smooth and intuitive user experience with reliable support.

Pros & Cons

Pros:

- Low minimum investment.

- Secured loans.

- High transparency.

Cons:

- Returns might be slightly lower compared to some platforms.

- Limited loan types.

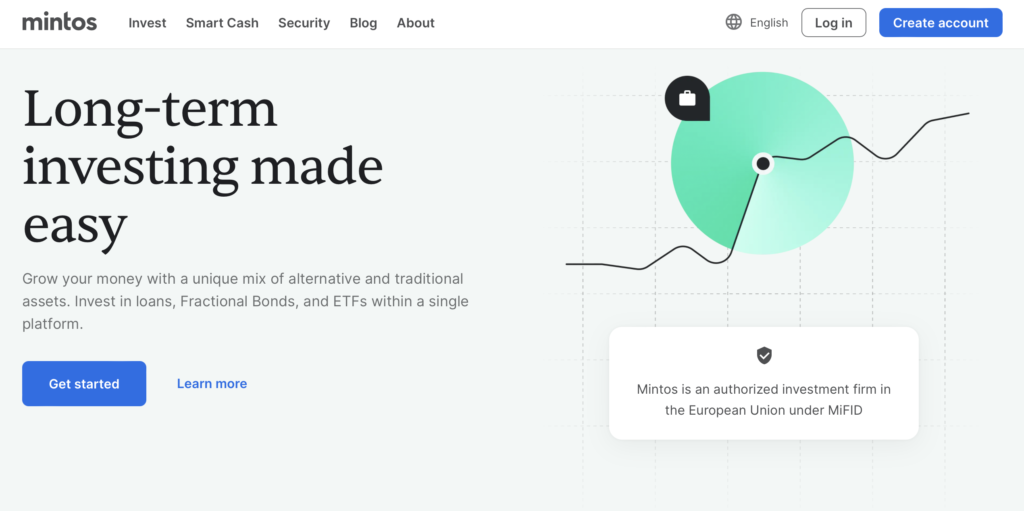

4. Mintos

Mintos is celebrated for its vast loan diversity and extensive marketplace, making it one of the best P2P lending platforms in Greece for investors seeking high diversification.

Key Features and Benefits

- Extensive loan marketplace with numerous loan originators.

- Offers both secured and unsecured loans.

- Advanced auto-invest features for seamless investing.

Loan Types and Investment Options

Mintos offers consumer loans, business loans, car loans, and agricultural loans with the option for buyback guarantees.

Minimum Investment and Expected Returns

- Minimum Investment: €10

- Expected Returns: 9-12% annually

User Experience and Customer Support

Mintos provides a robust platform with comprehensive loan details and responsive customer support, enhancing the user experience.

Pros & Cons

Pros:

- High loan diversity.

- Advanced auto-invest options.

- Competitive returns.

- Transparent platform with detailed information.

Cons:

- More complex platform for beginners.

- Potential risks with certain loan originators.

Call to Action: Start investing with Mintos for diversified and competitive returns.

5. Crowdpear

Crowdpear is an emerging P2P lending platform focused on providing high returns and innovative investment opportunities, making it one of the best P2P lending platforms in Greece for investors seeking growth.

Key Features and Benefits

- High return rates compared to traditional investment options.

- Innovative loan types and investment opportunities.

- Transparent and user-friendly interface.

Loan Types and Investment Options

Crowdpear offers personal loans, business loans, and real estate loans, often with higher return potentials.

Minimum Investment and Expected Returns

- Minimum Investment: €50

- Expected Returns: 10-14% annually

User Experience and Customer Support

Crowdpear features a user-friendly interface with comprehensive loan information and supportive customer service, making investing straightforward.

Pros & Cons

Pros:

- Higher return rates.

- Innovative investment options.

- Transparent and easy-to-use platform.

Cons:

- Higher minimum investment compared to some platforms.

- Relatively new platform with a shorter track record.

Call to Action: Invest with Crowdpear to explore high returns and innovative investment opportunities.

How to Choose the Best P2P Lending Platform in Greece

Factors to Consider

- Reputation and Track Record: Look for platforms with positive user reviews and a history of performance.

- Loan Types and Investment Options: Ensure the platform offers loans that match your investment goals.

- Interest Rates and Fees: Compare the returns and costs associated with different platforms.

- Minimum Investment Amount: Choose a platform that fits your budget.

- Risk Management and Diversification Tools: Opt for platforms that offer features to mitigate risk.

- User Experience and Customer Support: A user-friendly interface and responsive support are crucial for a smooth investment experience.

Tips for Successful P2P Lending in Greece

- Diversify Your Portfolio: Spread your investments across different loans and platforms to minimize risk.

- Stay Informed: Keep up with market trends and platform updates.

- Understand the Risks: Be aware of the potential risks involved in P2P lending.

Risks and Considerations

Potential Risks

- Default Risk: Borrowers may fail to repay.

- Liquidity Risk: Investments can be difficult to withdraw quickly.

- Platform Risk: The platform itself could face financial difficulties.

Mitigating Risks

- Diversification: Invest in multiple loans and platforms.

- Due Diligence: Research thoroughly before investing.

- Regular Monitoring: Keep track of your investments and platform performance.

The P2P Lending Landscape in Greece

Overview of the P2P Lending Market

Greece’s P2P lending market is gaining traction as more investors become interested in alternative investment opportunities and as digital platforms evolve. The growth in this sector is supported by increased financial inclusion and the convenience of online lending solutions. Among the Best P2P Lending Platforms in Greece, these advancements are making lending and borrowing processes more streamlined and accessible.

Regulatory Environment

Greece has established a regulatory framework that aims to ensure transparency and protect the interests of investors within the P2P lending market. Comprehensive regulations and oversight mechanisms are designed to mitigate risks and maintain market integrity. This regulatory approach contributes to the credibility of the Best P2P Lending Platforms in Greece, offering a secure environment for both lenders and borrowers.

Growth Potential and Trends

The P2P lending sector in Greece is on an upward trajectory, with increasing adoption and innovative trends paving the way for future expansion. Emerging technologies, such as advanced credit assessment tools and digital platforms, are driving growth and enhancing market efficiency. For investors, this evolving landscape presents promising opportunities, particularly through the Best P2P Lending Platforms in Greece that are at the forefront of this growth and innovation.

Conclusion

P2P lending offers a promising investment opportunity in Greece, with platforms like Esketit, Hive5, PeerBerry, Mintos, and Crowdpear leading the way. By understanding the market, choosing the right platform, and managing risks effectively, you can maximize your returns and enjoy a rewarding investment experience.

FAQ

Is P2P lending legal in Greece?

Yes, P2P lending is legal and regulated in Greece.

How much can I earn by investing in P2P lending in Greece?

Returns vary by platform, but investors can typically earn between 9-15% annually.

Are my investments protected if a borrower defaults?

Some platforms offer protection funds or buyback guarantees, but it varies by platform.

How do I start investing in P2P lending in Greece?

Choose a reputable platform, create an account, deposit funds, and start investing.

Is P2P lending taxable in Greece?

Yes, earnings from P2P lending are subject to taxation. Consult a tax advisor for specific guidance.

How can I minimize my risks when investing in P2P lending?

Diversify your investments, perform due diligence, and monitor your investments regularly.

Can I withdraw my investments from a P2P lending platform anytime?

This depends on the platform and the terms of the loans you’ve invested in. Some platforms offer secondary markets for selling your investments.