Crowdpear Review

Quick Overview

Platform Age

Launch Year

Loans Funded

Total Volume

Active Investors

Current Users

Minimum Investment

Per Loan

-

🎯

Investment Focus

Real estate loans secured by first-rank mortgages, business loans, and refinancing opportunities primarily in Lithuania and Romania.

-

📊

Expected Returns

9.5% to 14.5% annual returns, with average performance around 10-11.3% and loyalty bonuses up to 1%.

-

🛡️

Safety Features

EU regulated (ECSP license), all loans secured by real estate pledges, typically 60% LTV ratio.

-

💰

Liquidity Options

Secondary market available with 2% selling fee, listings valid for 14 days, discount options up to 25%.

Standout Features

EU Regulated (ECSP license from Central Bank of Lithuania)

Risk classification system for all projects (Class 1-5)

Loyalty program with up to 1% bonus interest

Real estate backed investments with tangible collateral

Investment Calculator

Total Investment Value

Investment Suggestion

Consider investing €10,000+ to qualify for the +0.5% loyalty bonus, which would significantly enhance your returns over the long term.

Our Experience with Crowdpear

We've been actively monitoring and investing with Crowdpear since its launch in December 2022, with a particular focus on their real estate-backed loans. Here's our detailed assessment based on our experience:

Test Portfolio Results

What Impressed Us

- Strong regulatory framework with ECSP license

- All loans secured by tangible real estate collateral

- Transparent risk classification system

- Consistent quarterly interest payments

- Backed by experienced PeerBerry team

Room for Improvement

- Limited loan volume and project availability

- No auto-invest feature yet

- Relatively high minimum investment (€100)

- Secondary market with 2% selling fee

- Relatively short platform track record

Real-World Performance

During our testing period, we invested in five different loans across different risk classes:

- Real Estate Project in Vilnius (€1,000): Class 2 risk rating, 10% annual return with quarterly interest payments received on schedule.

- Business Loan (€500): Class 3 risk rating, 11.5% return with all payments received on time.

- Development Project (€1,000): Multi-stage financing with 10.5% return, one payment delayed by 2 weeks but ultimately paid in full.

Key Observations

- Platform Growth: We've observed consistent growth, with February 2025 showing record loan volumes of €3.43 million funded.

- Security Measures: The risk assessment process and secured nature of loans add important safety layers.

- Geographical Expansion: The platform's recent entry into the Romanian market indicates strong growth potential.

- Management Experience: The connection to the PeerBerry team provides valuable expertise despite being a newer platform.

Final Opinion

Crowdpear stands out with its EU regulation, real estate secured loans, and connection to established P2P industry players. The platform has performed reliably during our testing period with consistent returns. Though it's still growing in terms of loan volume, its regulatory status and structured approach to risk management make it a solid addition to a diversified P2P portfolio, particularly for those seeking collateral-backed investments with strong regulatory oversight.

Platform Safety Analysis

⚠️ Key Risk Factors

- Risk of borrower default despite thorough vetting processes

- Collateral value fluctuations affecting potential recovery amounts

- Relatively short platform track record (operational since Dec 2022)

- Investments not covered by deposit guarantee systems

Regulatory Status

-

✓

Regulated by Central Bank of Lithuania

-

✓

Holds ECSP license for EU-wide operations

-

✓

Shareholders approved by Central Bank

-

✓

Complies with AML and KYC regulations

Investment Protection

-

✓

All loans secured by real estate pledges

-

✓

First-rank mortgages on most properties

-

✓

60% typical LTV ratio (up to 80% for later stages)

-

!

No specific platform protection fund

Platform Stability

-

✓

€21M+ total loan volume processed

-

✓

7,600+ active investors

-

✓

Backed by experienced PeerBerry team

-

!

Limited operating history (since Dec 2022)

Investor Protection Features

Collateral Security

All loans backed by tangible real estate assets

Security Measures

Two-factor authentication (2FA) available

Risk Assessment

5-class project risk classification system

Corporate Background

Connected to established Aventus Group

Company Structure & Ownership

Crowdpear is owned by an experienced team with strong connections to the P2P lending industry. The ownership structure consists of:

- Vytautas Stražnickas (50%)

- Vytautas Olšauskas (25%) - CEO, also a shareholder of PeerBerry

- Ivan Butov (25%)

All shareholders have been approved by the Central Bank of Lithuania, adding an extra layer of credibility. Arunas Lekavicius serves as the Chief Business Development Officer, bringing additional industry expertise to the platform.

The platform is backed by the profitable Aventus Group, which enhances its financial stability and provides important operational support during its growth phase.

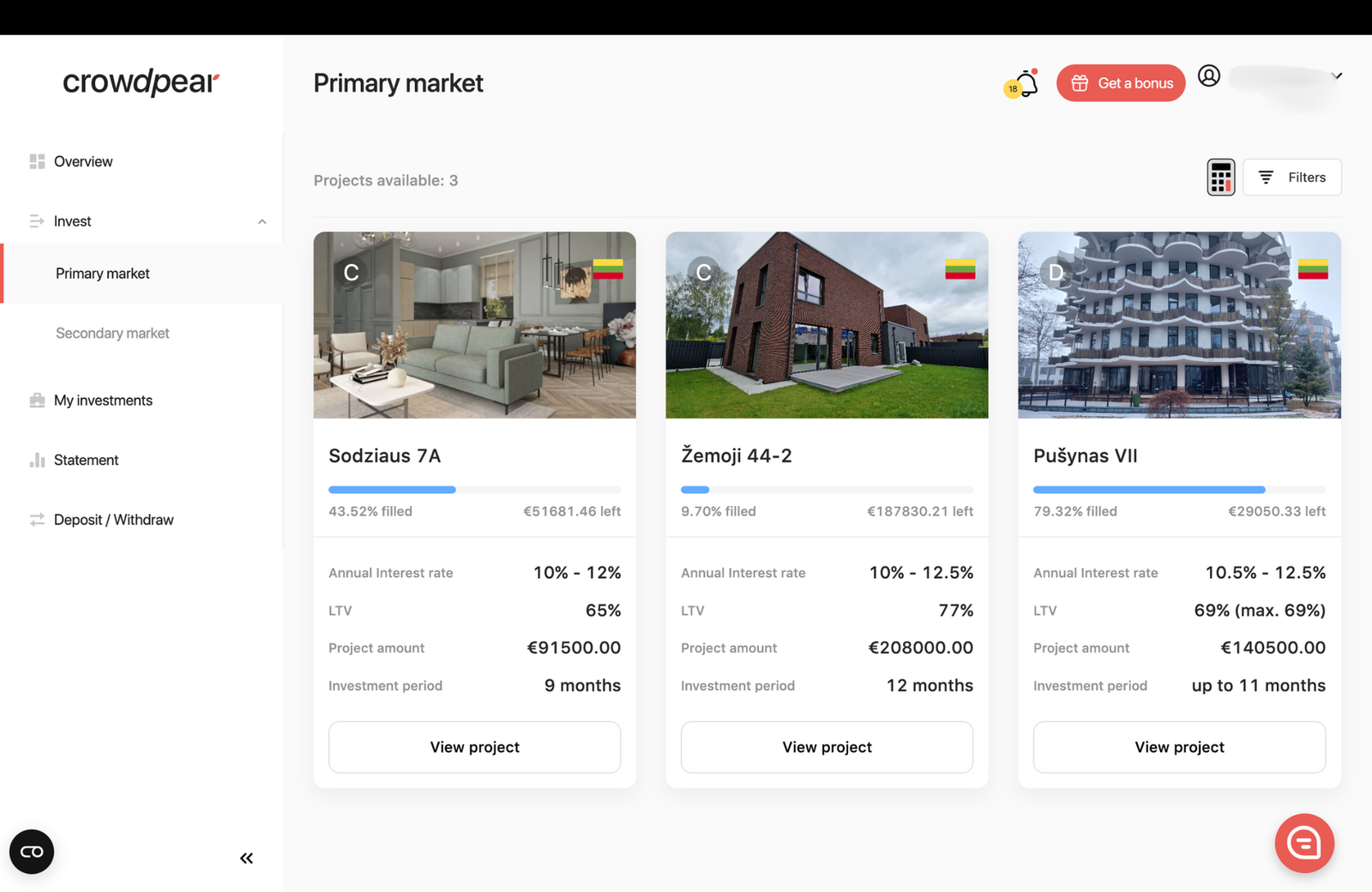

Platform Interface & Features

Main Dashboard

Clean, user-friendly interface showing investment portfolio and available projects

Loan Details

Comprehensive information about project risk, collateral, and terms

Secondary Market

Recently added marketplace for trading existing investments

Account Statistics

Performance tracking and transaction history

🏠 Investment Types

-

✓

Real estate loans with collateral

-

✓

Business loans with guarantees

-

✓

Refinancing opportunities

💰 Secondary Market

-

✓

Recently launched for liquidity

-

✓

2% selling fee applies

-

✓

14-day listing validity

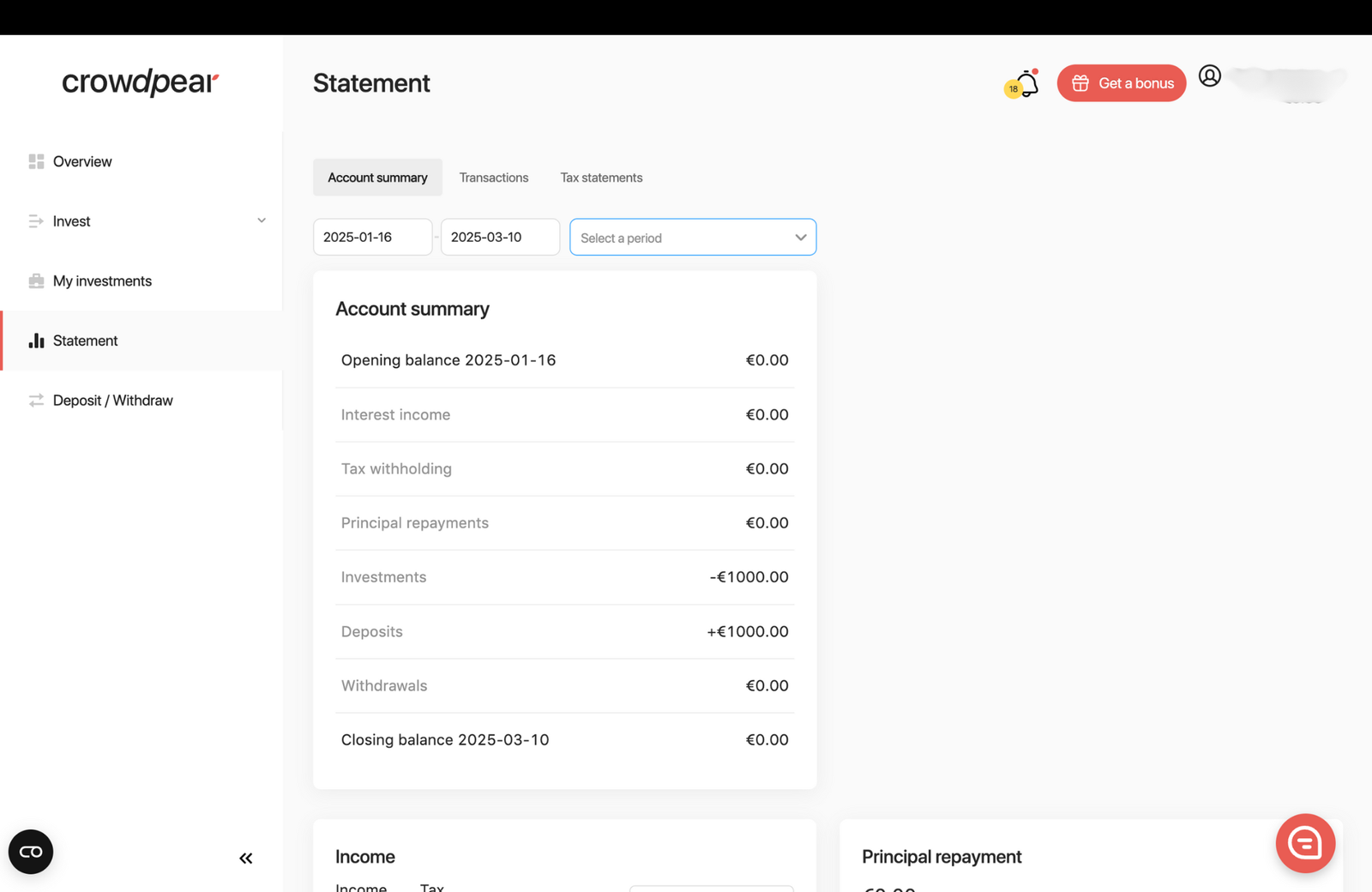

📊 Reporting Tools

-

✓

Transaction statements

-

✓

Tax reporting documents

-

✓

Portfolio performance tracking

Risk Classification System

Crowdpear employs a comprehensive risk assessment process, classifying all projects on a 5-point scale:

| Risk Class | Description | Typical Interest Rate |

|---|---|---|

| Class 1 (A) | Very good - low credit risk | 9.5% - 10.5% |

| Class 2 (B) | Good - moderate credit risk | 10.5% - 11.5% |

| Class 3 (C) | Satisfactory - average credit risk | 11.5% - 12.5% |

| Class 4 (D) | Poor - higher credit risk | 12.5% - 14.5% |

| Class 5 (E) | Very poor - too high credit risk | Not listed on platform |

This classification system helps investors make informed decisions based on their risk tolerance. Projects rated as Class 5 (E) are not listed on the platform as they do not meet Crowdpear's risk standards.

Payment Structure

Crowdpear uses a "bullet loan" structure for payments:

- Interest Payments: Made quarterly throughout the loan term

- Principal Repayment: Returned at the end of the loan term

- Typical Loan Duration: 6 to 12 months

- Development Projects: Often funded in stages

This payment structure provides investors with regular income through interest payments while maintaining the principal for the full investment term.

User Experience & Reviews

Recent User Reviews

"I've been investing with Crowdpear for over a year now and I'm very pleased with the platform. The regulatory status gives me peace of mind, and the property-backed loans add an extra layer of security. All interest payments have been received on time."

"The platform offers good returns with appropriate security measures. My only complaint is the limited number of available projects which can make it difficult to deploy capital quickly. The secondary market is helpful but the 2% fee seems high."

"Excellent platform for secured investments. The risk classification system is very helpful, and I appreciate the transparency around collateral. As a larger investor, the loyalty program with additional interest is a nice bonus."

What Users Like

- EU regulation and licensing provides confidence

- Transparent communication and project information

- Real estate collateral securing all investments

- Consistent and timely interest payments

- Connection to established PeerBerry team

Common Concerns

- Limited number of available investment opportunities

- No auto-invest feature for portfolio automation

- 2% fee on secondary market transactions

- Relatively high minimum investment amount (€100)

- 15% withholding tax for non-Lithuanian investors

Customer Support

Crowdpear offers customer support through multiple channels:

- Email Support: Typically responds within 1-2 business days

- Platform Chat: Available during business hours

- Help Center: Comprehensive FAQ section

Based on user feedback, the customer support team is knowledgeable and helpful, particularly with tax-related questions and account verification issues.

Getting Started

Create Your Account

Register with your email address, create a password, and complete the initial questionnaire. The process takes approximately 5 minutes.

Complete Verification

Verify your identity through the smartphone-based KYC process. This includes verifying your government ID and providing proof of residence.

Add Funds

Transfer funds to your account using bank transfer. The minimum investment amount is €100 per loan.

Start Investing

Browse available projects, review risk classifications and details, and select investments that match your risk tolerance and goals.

Eligibility Requirements

To invest on Crowdpear, you must:

- Be at least 18 years old

- Reside in the EU or EEA

- Pass the AML and KYC verification

- Verify your identity

- Declare your tax residency

- Ensure your country is not on the FATF list

Both individuals and companies can register to invest on Crowdpear.

Account Security

Crowdpear offers several security features to protect your account:

- Two-Factor Authentication (2FA): Highly recommended for all accounts

- Secure Password Requirements: Strong password policies

- Session Timeouts: Automatic logout after inactivity

- Encrypted Communications: SSL/TLS security for all data transmissions

We recommend enabling 2FA immediately after registration to maximize your account security.

Deposit Methods

Currently, Crowdpear supports bank transfers as the primary deposit method:

- SEPA Transfers: For EU-based accounts (typically processed within 1-2 business days)

- International Transfers: Available but may incur additional fees from intermediary banks

Unlike some other platforms, Crowdpear does not require individual IBAN accounts, which simplifies the deposit process.

Tips for Your First Investment

- Start with Class 1 or Class 2 loans to minimize risk while learning the platform

- Consider submitting your DAS-1 form early if you qualify for reduced withholding tax

- Diversify across multiple projects rather than investing all funds in a single loan

- Pay attention to the risk classification and LTV ratio when selecting projects

- Set up 2FA for added account security

Market Comparison

Platform Comparison

| Feature | Crowdpear | EstateGuru | PeerBerry | Mintos |

|---|---|---|---|---|

| Maximum Returns | 14.50% | 12.00% | 12.50% | 12.00% |

| Minimum Investment | €100 | €50 | €10 | €50 |

| Secondary Market | ✓ 2% fee | ✓ 2% fee | ✗ | ✓ 0.85% fee |

| Auto-Invest | ✗ | ✓ | ✓ | ✓ |

| Regulation | ✓ ECSP Licensed | ✓ Licensed | ✗ Parent company | ✓ ECSP Licensed |

| Collateral | ✓ All loans secured | ✓ All loans secured | ✓ Group guarantee | ✓ Some loans secured |

| Platform Age | Since 2022 | Since 2014 | Since 2017 | Since 2015 |

Top Alternatives

EstateGuru Established Real Estate

- ✓ Established platform since 2014

- ✓ Property-backed investments

- ✓ Operations across Europe

PeerBerry Related Platform

- ✓ Same management team

- ✓ Group guarantee protection

- ✓ Auto-invest functionality

Mintos Market Leader

- ✓ Largest P2P platform in Europe

- ✓ ECSP regulated

- ✓ High loan volume & liquidity

🔍 Key Differentiators

- EU regulated platform with ECSP license and Central Bank oversight

- Strong connection to established PeerBerry team and Aventus Group

- All loans secured by real estate collateral, mostly first-rank mortgages

- Attractive loyalty program with up to 1% additional interest

- Transparent risk classification system (Class 1-5)

Tax & Reporting

Tax Considerations

For investors using Crowdpear, it's important to understand the following tax implications:

Non-Lithuanian Residents

- • 15% withholding tax automatically deducted from earnings

- • Taxes transferred directly to Lithuanian Tax Inspectorate

- • May qualify for reduced rates under double tax treaties

- • DAS-1 form required for reduced rates (verify with home country)

Companies & Businesses

- • EU/EEA companies exempt from Lithuanian withholding tax

- • Companies responsible for tax compliance in their jurisdiction

- • Special documentation may be required to prove eligibility

Double Taxation Treaties

- • Many EU countries have treaties with Lithuania

- • Can reduce withholding tax to 5-10% in many cases

- • Submit DAS-1 form before first investment if possible

- • Form must be certified by your local tax authority

Tax Documents

Annual Tax Statement

Comprehensive annual statement showing all interest earned, withholding taxes paid, and transaction details. Available for download in PDF format from your account dashboard.

Transaction History

Detailed record of all account transactions including investments, interest payments, and withdrawals. Can be exported in CSV format for tax preparation or record-keeping.

DAS-1 Form

For non-Lithuanian investors seeking reduced withholding tax rates. This form needs to be completed, certified by your local tax authority, and submitted to Crowdpear before making investments.

Reporting Features

Portfolio Analysis

Track performance and investment distribution

Return Tracking

Monitor actual returns against projections

Export Options

Download statements in PDF and CSV formats

Tax Calculations

Review withheld taxes and net earnings

Tax Efficiency Tips

- Submit DAS-1 Early: If eligible for reduced withholding tax, submit your DAS-1 form before making your first investment to ensure all earnings benefit from the reduced rate.

- Business Investments: If you have a registered company in the EU/EEA, consider investing through your business to potentially avoid Lithuanian withholding tax.

- Record Keeping: Download and save all tax statements and transaction histories at the end of each tax year for your records.

- Local Declarations: Remember that despite Lithuanian withholding tax, you may still need to declare income in your home country according to local tax laws.

- Tax Professional: Consider consulting with a tax advisor familiar with both your local tax laws and cross-border investment income.

Final Verdict

Key Takeaways

- EU regulated platform with ECSP license for enhanced investor protection

- All investments secured by real estate collateral, minimizing risk

- Competitive returns ranging from 9.5% to 14.5% with loyalty bonuses

- Strong connection to established industry players (PeerBerry, Aventus Group)

- Transparent risk classification system for informed decision-making

✓ Recommended For

- Investors prioritizing regulatory oversight and compliance

- Those seeking collateral-backed investments with tangible security

- Medium to long-term investors looking for 9-14.5% returns

- Investors with larger portfolios who can benefit from loyalty bonuses

- Those interested in Lithuanian and Romanian real estate exposure

⚠️ Consider Alternatives If

- You need automated investing (no auto-invest feature yet)

- You prefer investing smaller amounts (€100 minimum per loan)

- You want a platform with longer track record (operating since 2022)

- You need immediate liquidity without fees (2% secondary market fee)

- You prefer unsecured loans with potentially higher returns

Ready to Invest in Secured Real Estate Loans?

🏛️ EU Regulated Platform with Collateral Security

* Terms and conditions apply. Investment involves risk of capital loss. Past performance does not guarantee future returns. All loans on Crowdpear are secured by real estate collateral, but recovery values may fluctuate with market conditions. Always conduct your own due diligence before investing.

Listen to Our Crowdpear Review

Listen to our audio summary of the Crowdpear review while browsing or on the go. Duration: 2:47

Why listen? Get the key highlights of our in-depth Crowdpear analysis including returns, risks, and who this platform is best suited for.